Add craft and invention to your life

The next time you want to make something, repair something, or find a new creative outlet, come to BARN. You’ll find a vibrant community of artisans and makers eager to help you get started. You’ll also find 10 well-equipped studios. These community workspaces offer online and in-person classes and the tools you need to explore everything from 3D printing and jewelry making to weaving, woodworking, and more. Come see for yourself!

Upcoming Classes & Events

How BARN works

Ready to get started?

Take a class

Everyone is welcome! Classes are online or at BARN and are open to anyone high school age and up. You don’t need to be a member — BARN classes are a great thing to do while visiting Bainbridge Island. In addition, summer and after-school classes are offered for teens and tweens. What will you make at BARN?

Find a Studio

Become part of a community that shares your passions. Each of BARN’s 10 studios focuses on a discipline such as fiber or wood. If you already know what you’re interested in, visit that studio page to find out what you can learn there, what equipment is available, and where to begin. Still searching for inspiration? Sign up for a studio orientation session, subscribe to the studio newsletter, or contact the studio lead.

Fiber Arts

Basketry

Needle arts

Sewing

Surface design

Weaving

more…

Fiber Arts

Glass Arts

Fused Glass

Glass Mosaics

Stained Glass

Torchworking

more…

Glass Arts

Jewelry & Fine Metals

Beadwork

Enameling

Jewelry Making

Lapidary

more…

Jewelry & Fine Metals

Kitchen Arts

Baking

Cooking

Global Cuisine

Food Production

more…

Kitchen Arts

Media Arts

Photography

Podcasting

Videography

more…

Media Arts

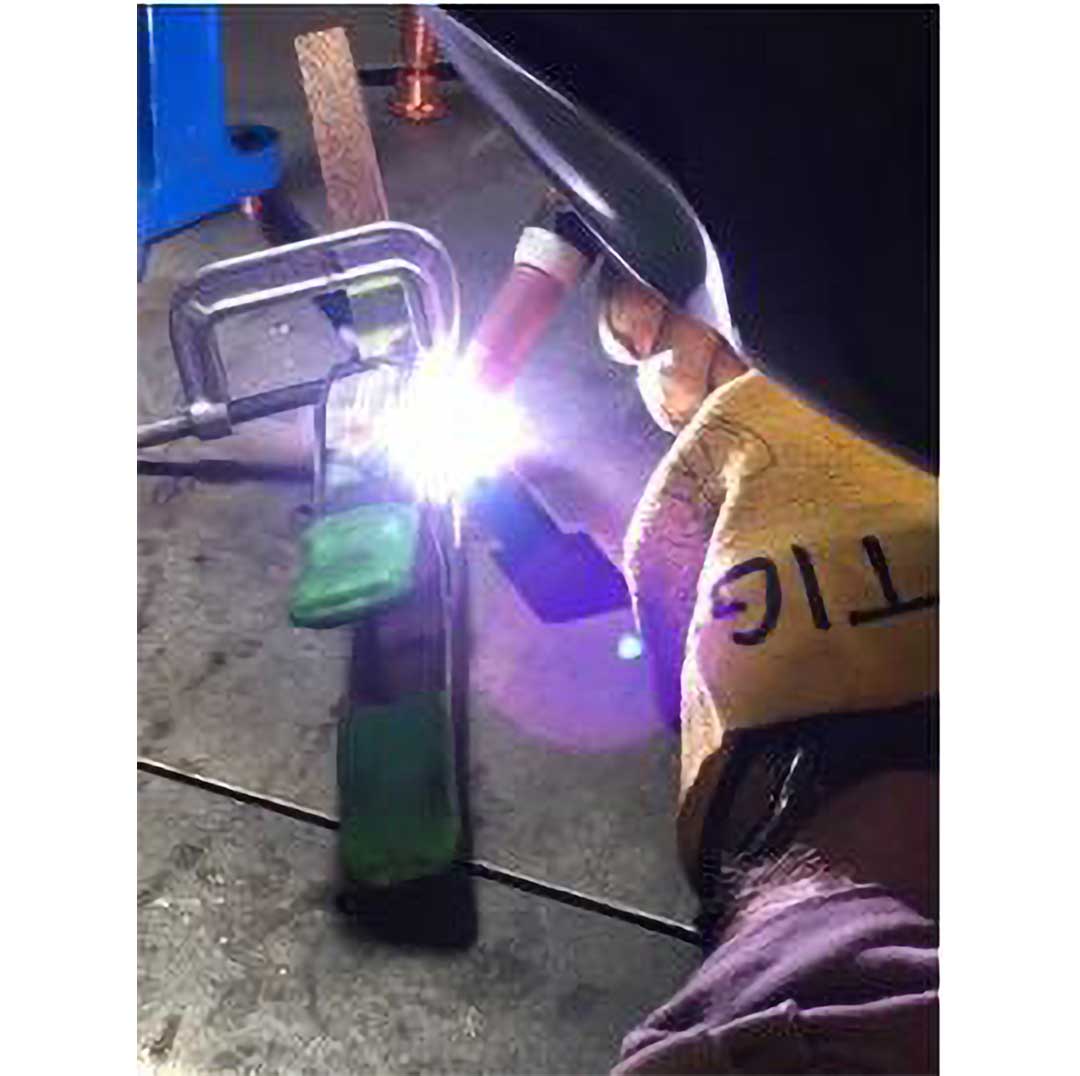

Metal Fabrication

Foundry

Machining

Sheet Metal

Welding

more…

Metal Fabrication

Print & Book Arts

Book Arts

Letterpress

Printmaking

more…

Print & Book Arts

Woodworking & Small Boat Building

Woodturning

Woodworking

Small Boatbuilding

more…

Woodworking & Small Boat Building

Become a Member

Join our active community of makers and realize the full benefit of BARN. Your membership includes access to open studio times, discounts on classes, and a key fob customized to your studio interests and tool certifications. BARN offers individual or family memberships that can be paid monthly or annually. Discounted memberships are available to students, educators, and active military.

BARN News

BARN News: Don’t Miss These Upcoming Classes

BARN offers both online and in-person classes. Sewing: Pants Fit & Sew with Marla Kazell 3 meetings, beginning May 30, 9 AM ...Full story »

A Celebration of Art and Poetry

The April 5 opening reception for the Ars Poetica exhibit was a great success, with artisans and poets mingling and talking about their work. ...Full story »

A Year of Healthy Growth: Read BARN’s 2023 Impact Report

I’m pleased to share our 2023 Impact Report, which highlights some of BARN’s achievements in growing and inspiring our creative community. BARN remains in strong financial health while ...Full story »

Saturday, May 11

Saturday, May 11

.jpeg)